What is SECP? How can I register my small business in Pakistan? The answers to these questions are simpler than you might think. Registering a company in Pakistan involves a few easy steps including name reservation, documents preparation, and submission to the Securities & Exchange Commission of Pakistan (SECP).

Let’s dive in…

We have put a lot of effort to help entrepreneurs find simplified and accessible information to demystify the process of registering a small business with SECP in Pakistan.

Are you considering starting a business in Pakistan but unsure about the process of registering a company with SECP? No worries at all. While understanding the legal and procedural steps involved in registering a company in Pakistan is crucial for any aspiring entrepreneur, they’re easy to grasp. From the various business entity types to the intricate registration process, there are several factors to consider.

In Pakistan, the process of registering a company involves understanding the legal and financial implications, choosing the appropriate business structure, and complying with the required registration fees and documentation.

Dealing with legal procedures in Pakistan, such as registering a company with the Securities & Exchange Commission of Pakistan (SECP), can be very easy if approached with proper guidance. By breaking down the process into easier and manageable steps, you can get a clear understanding of the legal requirements and successfully go through the process efficiently wthout any further help.

In this post, I’m going to show you EXACTLY how to register your business in Pakistan.

In fact, this is the exact process that I used to register my business with SECP.

I will provide an in-depth understanding of the business registration process, including the types of business entities, the necessary forms and digital signatures, as well as the key considerations for choosing a business structure. Understanding these fundamental aspects will help you understand the registration process with confidence and ensure compliance with the legal framework without any hassle.

Before going to the necessary details, let me give you a short introduction of SECP (Securities & Exchange Commission of Pakistan) as we will be using this term repeatedly.

What is SECP and How it Works?

Securities and Exchange Commission of Pakistan (SECP) is the premier regulatory authority tasked with overseeing the integrity of Pakistan’s capital markets and the financial services industry. The SECP’s mandate encompasses a broad spectrum of responsibilities, including the regulation of securities and corporate sectors, with an overarching aim to ensure transparent and equitable markets. As a guardian of investor interests, the SECP is committed to promoting confidence in the financial system, which is fundamental for the growth and prosperity of Pakistan’s economy.

The SECP creates rules, monitors market participants, enforces regulations, educates investors, and collaborates with other entities to maintain best practices. The overall goal of the SECP is to foster a stable, transparent, and efficient financial market environment that attracts investments and contributes to the economic development of Pakistan.

Now, let’s get back to our main agenda of this article that is business registration in Pakistan. ??

Why Register a Company in Pakistan | Benefits of Business Registration

Registering a company in Pakistan offers numerous benefits and advantages for entrepreneurs and businesses. It provides legal recognition to the business entity, ensuring its credibility and authenticity. Here are some key reasons why registering a company in Pakistan is essential:

1. Legal Protection

Registering a company grants it legal protection, separating the personal assets of the owners from those of the business. This means that if the company faces any legal issues or financial liabilities, the personal assets of the owners will not be at risk.

2. Access to Funding

Registered companies have easier access to funding from banks and financial institutions compared to unregistered businesses. This is because registered companies are seen as more credible and trustworthy by lenders.

3. Business Expansion

Registering a company allows for future business expansion and growth opportunities. It provides a solid foundation for attracting potential investors and partners, as well as entering into contracts and agreements with other businesses.

4. Brand Building

Registering a company gives it a unique name and brand identity, which can help in building a strong reputation and attracting customers. A registered company is also able to protect its brand through trademark registration.

5. Tax Benefits

Registered companies are eligible for various tax benefits and incentives offered by the government. This includes tax exemptions, deductions, and lower tax rates for certain industries or regions. These benefits can help reduce the financial burden on the company and increase profitability.

Company Registration Types — Registration of Company | SECP

In accordance with the provisions set forth in the Companies Act of 2017, individuals in Pakistan are afforded the opportunity to establish their business entities under three distinct legal frameworks:

1. Single Member Company:

This structure is tailored for entrepreneurs who wish to reap the benefits of corporate personality while retaining sole ownership and control over the business. It’s an ideal option for individual proprietors seeking to limit personal liability.

2. Private Limited Company:

Designed for small to medium-sized ventures, this type of company allows for a minimum of two and a maximum of fifty members. Its shares are not publicly traded on stock exchanges, which provides greater privacy and control to the shareholders.

3. Public Limited Company:

Suited for large-scale businesses, a public limited company opens the door to raising capital by offering its shares to the public on the stock exchange. It requires a minimum of three members and has no upper limit on the number of shareholders, thus providing the potential for expansive growth and shareholder diversity.

Here is an overview of legal entities in Pakistan. ??

| Type of Entity | Minimum No. of Shareholders | Minimum Capital Requirement | Standard Time of Incorporation |

|---|---|---|---|

| Private Limited Company | 2 | PKR 100,000 (~USD 823) | 6 weeks |

| Single Member Company | 1 | PKR 100,000 (~USD 823) | 4 weeks |

| Public Listed Company (Listed) | 3 | 200 million (~USD 1.6M) | 6 weeks |

| Public Listed Company (Unlisted) | 3 | PKR 100,000 (~USD 823) | 6 weeks |

| Branch Office | No shareholders | N/A | 7 weeks |

| Liaison Office/ Representative Office | No shareholders | N/A | 7 weeks |

*It’s important to note that the above information is a general overview, and specific requirements and procedures may vary. Entrepreneurs and businesses looking to register a company in Pakistan should consult the latest regulations and guidelines provided by the SECP for accurate and up-to-date information.

So, mainly it depends on you and the size of the company that you want to register with SECP. In the coming sections we will discuss the registeration process.

How to register a company in Pakistan? It’s very simple. Registering a company in Pakistan is a systematic process, guided by the Companies Act of 2017. This process involves several easy steps including name approval or reservation, documents submission to SECP, getting certification, deposit of shares in account, and registeration for income and sales tax.

Business Registration Process | SECP Registration Process

Once we’ve familiarized ourselves with the eligible company types, let’s delve into the process of actually registering a company. This involves gathering all the necessary documentation, choosing a suitable business name, and completing the registration forms as per the legal requirements.

It’s important to understand the specific steps involved and any regulations that apply to the type of company being registered.

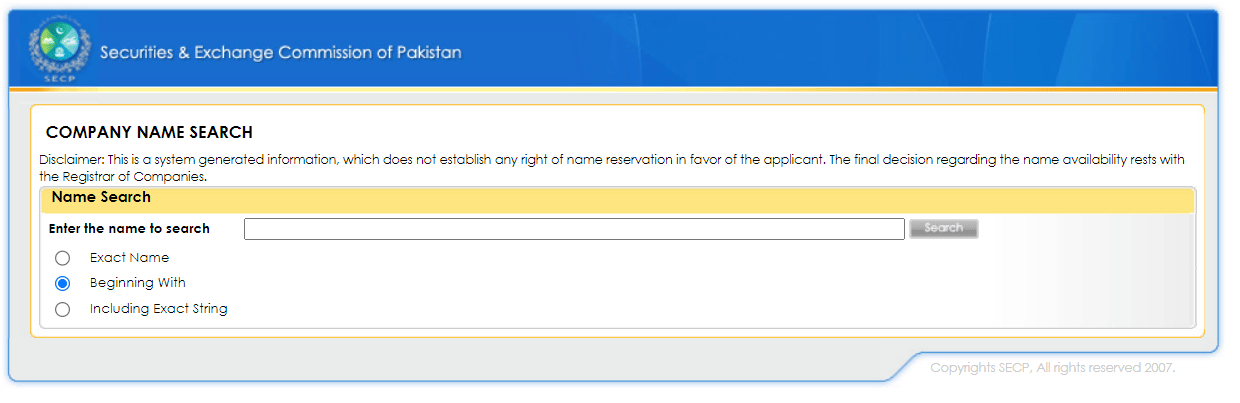

Before applying to the Securities and Exchange Commission of Pakistan for company registration, check the company name on their website. Once the name is confirmed, proceed with company registration in Pakistan.

You can search for company names availablity on the official website: Company Name Search SECP.

Registering a Company Name

The first step is registering the company’s name. Before registering your company’s name, make sure to consult section 10 of the Companies Act (2017) to ensure that your chosen name complies with the regulations.

This section contains a list of prohibited terms to consider. Once you have chosen a unique name for your company, you can proceed to create an online account with SECP to verify the name’s availability.

If the company name you have chosen is available, you can easily reserve it with these steps:

- Start by logging into the e-services portal available on the SECP website.

- If you are a Pakistani national, ensure you have your CNIC at hand. Foreign nationals will require their passport for identity verification.

- Opt for the ‘Fast Track Registration Services (FTRS)’ if you’re looking for expedited same-day registration services.

- Fill out the necessary details on the online form accurately and proceed to submit your application.

- Upon submission, you will be sent a security code, which can either go to your registered mobile number or email, depending on your preference.

- Once you confirm the security code, a Personal Identification Number (PIN) will be issued to you.

- Following this, a challan (fee voucher) will be generated. This challan can be paid at selected branches of MCB or UBL, or you can also pay directly online using a credit or debit card.

- Provided that the company name does not contain any restricted words, you should expect to receive confirmation that the name has been reserved under your credentials within one business day.

You can visit the website for fee calculations: SECP Incorporation Fee Calculator

By following these steps, you can secure your desired company name swiftly and begin the rest of the registration process with confidence. You will recive this kind of message from the SECP.

In case the system experiences any issues, SECP provides convenient offline services where individuals can personally visit the registrar’s office to submit their company name applications.

This offline process typically takes 3 to 5 business days for completion. Once approved, the person will be granted a license to utilize the authorized name in all official documents pertaining to company incorporation.

Company Incorporation

For registering a company in Pakistan, you must compile a set of documents that are essential to the process. These documents include:

- The Articles of Association, which outline the company’s bylaws, structure, and operational guidelines, and the Memorandum of Association, detailing the company’s purpose, scope of operations, and the process for its incorporation.

- Photocopies of the National Identity Card (CNIC) for Pakistani directors, CEO, and nominee, whereas foreign nationals will need to provide copies of their passports.

- In instances where the business is of a specialized nature, it is mandatory to procure a No Objection Certificate (NOC) or a letter of intent from the relevant government authority or regulatory body.

- For foreign companies establishing a presence in Pakistan, the submission must include information about the directors and their nationalities, a profile of the company, and authenticated copies of the company’s charter. You’ll also need to submit the Memorandum of Association and Articles of Association tailored to international standards.

- Written consent from the subscribers to the memorandum authorizing a representative to submit the necessary documents for registration.

- Proof of payment for the registration fee, which is determined by the method of submission and the nominal share capital. For online submissions with a nominal capital not exceeding Rs. 100,000, the fee is Rs. 1800. For offline submissions, the charge is Rs. 3500.

For your ease, you may use a single page Articles of Association available at SECP website.

What’s the Articles of Association? Think of Articles of Association as the rule book. It defines what your company is all about and how it operates. The Articles of Association outline the internal rules and regulations that govern the company’s operations, including its management structure, decision-making processes, and shareholder rights.

Gathering these documents is a critical step towards legally establishing your business in Pakistan and ensuring that all regulatory compliance requirements are met.

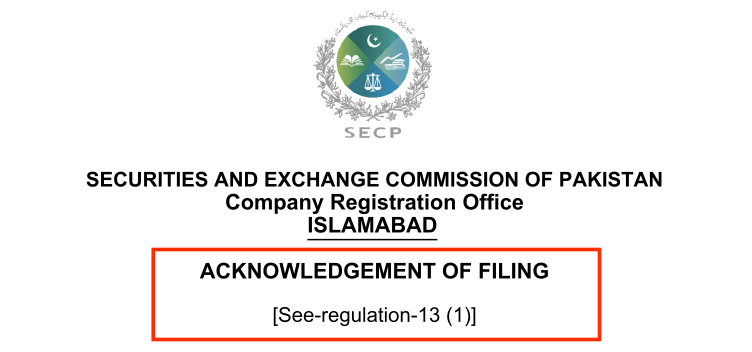

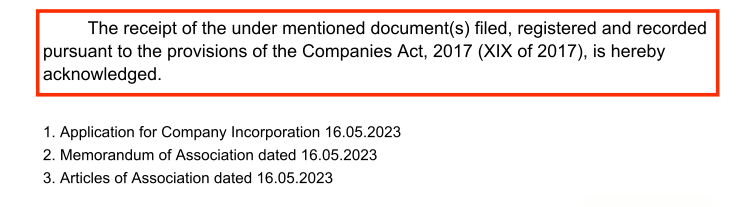

After filing for registeration, you will get this acknowledgment from them.

The acknowledgement email from SECP will mention three important documents, such as the article of memorandum, article of association, and application of company name, which are essential for the company’s registration process.

These documents play a crucial role in defining the structure and operations of the company and are vital for regulatory compliance. See it below.

The dates will be your submissions date. In our case it’s shown above.

Registering a Company for Income and Sales Tax

To legally register a company in Pakistan, possession of a National Tax Number (NTN) is indispensable. The NTN application must be filed at the Regional Tax Office under the Federal Board of Revenue (FBR). Here’s what you’ll need to secure an NTN:

- A thoroughly completed NTN registration form.

- Evidence of your business registration.

- A copy of the Memorandum and Articles of Association, which establish your company’s structure and regulations.

- The details of an active bank account in the company’s name.

- Photocopies of the valid Computerized National Identity Cards (CNICs) of all directors of the company.

- Documentation confirming the company’s business address.

These documents are crucial for acquiring an NTN, a fundamental step that validates your company’s tax registration and is a prerequisite for company registration in Pakistan.

Businesses are required to charge sales tax if they sell locally produced or imported products, in accordance with the Sales Tax Act 1990. However, certain businesses dealing with specific items such as medicines, computer software, poultry feed, and unprocessed agricultural produce are exempt from this requirement.

If your business is exempt, you can skip this step, else you have to register for the sale tax.

You will get a Sale Tax Registration Number (STRN), charge it on every receipt, and submit the tax collected by the 15th of the following month.

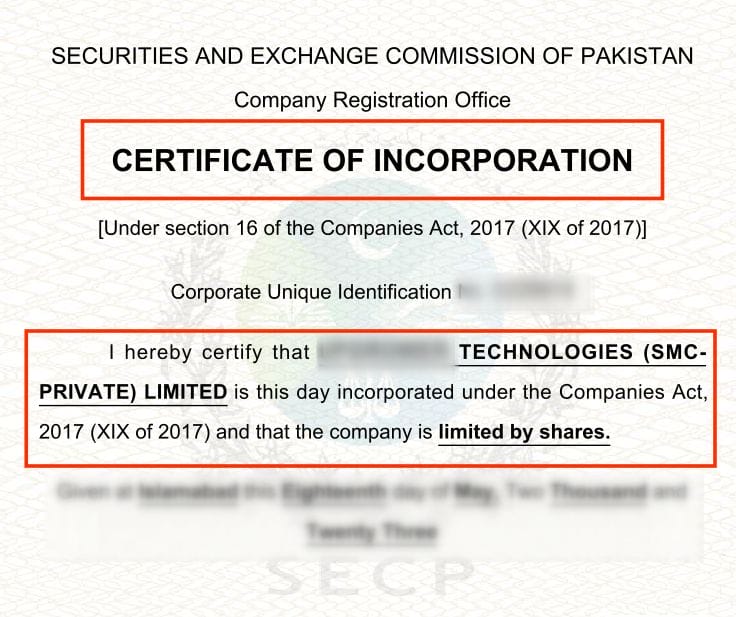

Certificate of Incorporation

After assembling all the necessary documents and paying the appropriate fees, you’ll proceed to submit these documents to the Securities and Exchange Commission of Pakistan (SECP). SECP will review your submission, ensuring all information is accurate and in order before granting its approval. In parallel, the National Institution of Facilitation Centre (NIFC) is responsible for creating and issuing the corporate seal for your company.

Upon the successful validation and endorsement of your documents by SECP, you will receive the Certificate of Incorporation. This document serves as the official and legal green light for your business to begin operations within Pakistan. Following this, it is incumbent upon the shareholders to deposit funds equivalent to their shareholdings into the company’s designated bank account.

SECP has significantly streamlined the registration process, and the option to submit the registration fee online represents a substantial advancement. With these improvements, registering a company in Pakistan has become a seamless digital endeavor.

In order to avoid surprises, potential business owners are encouraged to calculate their total costs in advance, considering both registration and filing fees, so they are fully prepared for the financial aspect of their new venture.

Post Incorporation Requirements

After successfully registering a company in Pakistan and obtaining the Certificate of Incorporation, there are certain post incorporation requirements that need to be fulfilled. These requirements ensure that the company operates legally and complies with the relevant laws and regulations. You can find all the requirements here in Post Incorporation Requirements(PDF)

FAQs Regarding SECP Registration

Let’s answer the common questions people ask.

How can I register my small business in Pakistan?

To register your small business in Pakistan with SECP, follow these steps:

- Check for the business name availability through the SECP e-services portal.

- Reserve the desired company name after ensuring it fulfills all regulatory requirements.

- Prepare the necessary documents including Articles of Association, Memorandum of Association, copies of

- National Identity Card or passports, and any NOC (if applicable).

- Submit the filled registration forms along with the required documents and pay the necessary fees.

- After document submission, SECP will review and, if everything is satisfactory, issue a Certificate of Incorporation.

- Register for taxes by obtaining a National Tax Number (NTN) through the Federal Board of Revenue (FBR).

- Meet any post-incorporation requirements such as company seals, stock certificates, and statutory registers.

What are the benefits of registering a company in Pakistan?

Registering a company in Pakistan provides legal protection, credibility, facilitates access to funding, aids in expansion and opportunities for growth, helps in building a recognizable brand, and offers potential tax benefits and incentives.

What types of companies can be registered in Pakistan?

You can register various company types in Pakistan, such as a Single Member Company, a Private Limited Company, a Public Limited Company (Listed or Unlisted), a Branch Office, or a Liaison/Representative Office.

What is the processing time and fee structure for registering a company in Pakistan?

The standard time of incorporation varies from 4 to 7 weeks depending on the type of company. The minimum capital requirement ranges from PKR 100,000 to PKR 200 million for different types of entities, with corresponding fees for online and offline submissions.

What are the post-incorporation requirements in Pakistan?

After incorporation, companies must comply with several regulatory requirements including creating a company seal, issuing share certificates, setting up statutory registers, and any specific requirements that may apply to their industry or business type.

What are 4 disadvantages of incorporating?

Incorporation has several disadvantages that business owners should be aware of. These include formalities and expenses, corporate disclosure, separation of control from ownership, greater social responsibility, increased tax burden in certain cases, and detailed winding up procedures. However, company registration in Pakistan is compulsory.

Can a foreigner own a company in Pakistan?

In Pakistan, foreign investors have the opportunity to establish fully foreign-owned private limited companies (LLCs). For the registration of this type of company, a minimum of two shareholders is required. Foreign company registration in Pakistan is very easy.

Summary: Company Registration in Pakistan

When entering the entrepreneurial landscape of Pakistan, registering a company is a foundational step that provides legitimacy and sets the stage for all future operations. Here, I’ll walk you through the streamlined process of registering your business, ensuring you’re well-equipped to commence your corporate journey in Pakistan.

Step 1: Decide Company Type Begin by identifying the type of company you aim to establish. The options range from a Single Member Company (SMC) to a private or public limited company, each tailored to different business needs and scales. This decision will influence your registration process, capital requirements, and compliance obligations.

Step 2: Name Reservation Your company’s name is its identity, so choose it carefully. It should resonate with your business ethos while being unique and non-infringing on existing trademarks. The SECP’s online portal offers a name search feature to vet your desired name against existing registrations, ensuring conformity with legal standards.

Step 3: Documentation Gather documents integral to the registration process. These generally include identity proofs of the promoters, the company’s Memorandum and Articles of Association, Form-I as a declaration of compliance, and relevant declarations from the directors and CEO. Payment proof of the registration fee solidifies your submission.

Step 4: Submission of Documents Once your dossier is complete, navigate to the SECP eServices portal for online submission. The digital age facilitates this step with the requirement of a digital signature from NIFT. If you prefer physical queues, offline submissions are also entertained at SECP offices.

Step 5: Register for Taxes Upon incorporation, tax registration is non-negotiable. Secure a National Tax Number (NTN) from the Federal Board of Revenue (FBR) for income tax purposes. If your business activities are within the sales tax regime, acquiring a Sales Tax Registration Number (STRN) is equally imperative.

Step 6: Bank Account A corporate bank account is your reservoir for capital transactions. Post the opening, the minimum decided capital requirement should be deposited, reflective of your company structure.

Step 7: Certificate of Incorporation With due diligence from the SECP and the successful verification of your documents, you’ll be endowed with the Certificate of Incorporation. This is the green light for your business operations to officially commence in Pakistan.

Important Notes: Flexibility in the digital era allows for both online and offline processes. The online medium is cost-effective and efficient, aiming to finalize your application within four working hours if submitted by noon. The registration fee structure is contingent on your authorized capital and your chosen mode of application.

For Specific Details and Guidance: SECP’s official resources are your encyclopedias for the registration maze. Access their guidelines, application forms, and FTRS service to comprehensively understand the regulatory sphere you’re stepping into.

The harmony of your company’s registration with SECP’s protocols is more than a legal formality—it’s a strategic move for operational fluidity and credibility. With the steps outlined above, I’ve demystified the process to ensure that your venture’s inauguration in Pakistan’s corporate sector is a triumph. You can have these steps in the following PDF File of SECP Process Made Simple.

Hope you enjoyed the article, let me know about your experience of the SECP process. Wish you best of luck!