Author: Faheem Rafique

I'm Faheem Rafique, a seasoned news journalist with ten years of experience, committed to delivering insightful and accurate reports on Pakistan's dynamic socio-political environment. My aim is to present not just news, but a deeper understanding of Pakistan's heartbeat.

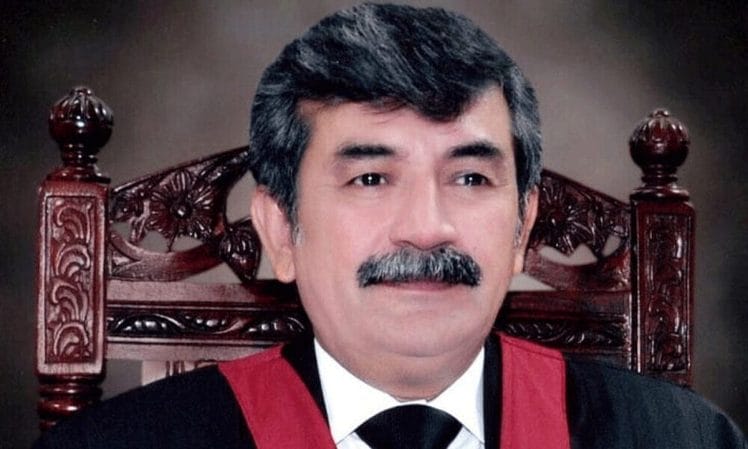

In a move that reverberated through the judicial corridors of Pakistan, Justice Shahid Jamil Khan opted to step down from his position at the Lahore High Court (LHC) on Friday. His decision came to light through a resignation letter where he invoked Article 206(1) of the Constitution of the Islamic Republic of Pakistan, choosing to leave his decade-long service with immediate effect. Justice Khan’s departure from the bench is not an isolated occurrence but part of a string of recent resignations that have struck the upper echelons of Pakistan’s judiciary. Earlier in the week, the legal fraternity witnessed the exit…

Is the Pakistani rupee staging a comeback against the omnipotent dollar? In the high-stakes game of currency markets, the local currency made a noteworthy, albeit modest, pivot in the right direction. During the brisk morning trade hours in the inter-bank market this Friday, market watchers caught a glimpse of the rupee appreciating by a slender margin of 0.12%. Clocking in at 10:15 am, the rupee was seen flirting with a figure of 279.15, an uptick of Re0.33 against the greenback. The whisper of this uptrend follows a similar pattern from Thursday’s close, where the rupee ceased the day’s trading at…

In the realm of global finance, all eyes are on the U.S. job market as investors worldwide grasp for indicators that could shape federal policy. The anticipation is palpable, with the latest tech earnings providing a glimmer of optimism amid concerns of an economic downturn. As we await pivotal U.S. jobs data, the question on everyone’s mind is whether the figures will fuel bets for rate cuts, a move that could significantly alter the investment landscape. Adding a dose of enthusiasm to the market, Meta Platforms and Amazon.com have delivered impressive quarterly results, propelling their stocks upward in after-hours trading.…

Is Malaysia’s palm oil industry facing a slippery slope? The scene at the Bursa Malaysia Derivatives Exchange on Friday seemed to indicate just that, with Malaysian palm oil futures taking a notable dip. The benchmark palm oil contract for April delivery dropped by 38 ringgit, or 1%, to 3,760 ringgit ($795.26) a metric ton as trading kicked back into gear following a holiday. This downturn isn’t an isolated event; the commodity has seen a 6% fall over the week, raising eyebrows and concerns among investors and industry watchers alike. The root of the slump seems to stretch beyond Malaysian shores,…

Is Pakistan’s economic horizon seeing a glimmer of hope? The Pakistan Stock Exchange (PSX) certainly indicated as much, as the benchmark KSE-100 soared nearly 500 points in early trading this Wednesday. This uptick in market confidence comes amidst key economic developments, particularly regarding the resolution of the nation’s persistent circular debt issue. The surge took the index to an intra-day zenith of 62,399.53; however, this ascent was momentarily tempered by political ripples stemming from a new court ruling against former Prime Minister Imran Khan in the Toshakhana case. Despite these political tremors, market optimism did not wane. By mid-morning, the…

In a notable shift from usual market trends, Australian shares have ascended for an eighth straight session, predominantly propelled by a robust performance in the financial sector. This rise coincided with the release of consumer price inflation data, which surprisingly dipped to a two-year low in the December quarter. Despite early setbacks, the S&P/ASX 200 index rallied, climbing 0.3% to reach 7,620 by 0043 GMT, marking a conclusion at a four-week high the preceding day. This turnaround in market fortune challenges the conventional wisdom that often correlates a cooling economy with bearish stock behavior. The Australian Bureau of Statistics revealed…

As thick fog engulfs parts of China, maritime and urban activities come to a standstill, illustrating the profound impact of weather conditions on modern life. In an abrupt turn of events, the bustling traffic on the Qiongzhou Strait, a critical maritime channel off the coast of China’s Guangdong province, has been suspended. The veil of fog, dense enough to obscure visibility to less than 200 meters, prompted this emergency response, showcasing nature’s ability to halt even the most advanced of human operations. Chinese state media reports that the halt in the flow of aquatic traffic began late Tuesday, and the…

Is the tide turning for global wheat markets? In a departure from the rising trend since September, Chicago wheat futures are on the brink of a monthly decline. This shift reflects a broader story of fluctuating commodity prices, with Russian wheat export prices falling due to a glut in the Black Sea region and a robust US dollar adding further pressure on American exports. As we navigate through the intricacies of these market dynamics, it’s apparent that a confluence of factors is reshaping the grain landscape. Notably, the dip in Russian wheat prices comes against the backdrop of a supply…

Is Japan’s commitment to a flexible exchange rate a cornerstone of its economic stability? Amidst a backdrop of global uncertainties, the International Monetary Fund (IMF) reiterates that Japanese authorities are unwavering in their stance on exchange rate flexibility, a key element acting as a buffer in an ever-volatile market and fortifying the Bank of Japan’s push for price stability. During a recent news conference, Krishna Srinivasan, director of the IMF’s Asia and Pacific Department, expressed alignment with Japan’s monetary stance. “We’ve had very good discussions with Japanese authorities on exchange rate issues,” he noted, underlining a shared perspective between the…

Could China’s property woes be deepening the iron ore market’s downturn? That’s the pressing question as iron ore futures continue their slide, with China’s latest factory data painting a bleak picture for investors. Amidst these concerns, Wednesday witnessed the most-traded May iron ore contract on China’s Dalian Commodity Exchange (DCE) fall 2.32% to 968 yuan ($134.80) per metric ton. Similarly, the benchmark March iron ore on the Singapore Exchange was down 1.57% at $130.75 a ton. In the world’s leading consumer market of China, manufacturing activity contracted for the fourth consecutive month in January, signaling stubborn challenges in regaining economic…