Author: Sarmad Ahsan

I am Sarmad Ahsan, a business analyst and an adept entrepreneur whose ten-year odyssey in the realm of business writing and reporting has been marked by a steadfast dedication to precision and an astute attention to detail. My professional voyage has been singularly focused on distilling complex business concepts into compelling narratives that resonate with and enrapture a diverse audience. My commitment to the craft has honed my ability to deliver stories that not only inform but also persuade and engage, solidifying my reputation as a trusted source in the business community. As readers delve into my work, they encounter a fusion of expertise and eloquence, a signature of the insightful and impactful content I am known for.

How do geopolitical events influence regional stock markets? As tensions escalate in the Middle East, investors find themselves navigating through yet another layer of complexity. Tuesday’s stock market activity in the Gulf provided a glimpse into the impacts of regional instability on financial markets, with most indices closing lower amidst rising tensions. Israeli military operations in Gaza and U.S. actions against Iran-backed Houthis in Yemen, who have disrupted vital oil trading routes with their maritime attacks, have cast a shadow over investor confidence. The strikes in Gaza’s southern city of Khan Younis, leading to significant Palestinian casualties, and the ongoing…

Is the interim government’s investment in healthcare the remedy Punjab’s ailing health infrastructure needs? In Lahore General Hospital (LGH), a significant leap forward has been made with the inauguration of state-of-the-art MRI and CT scan machines, a move that marks a broader effort to overhaul public health services in the region. These advanced medical devices, which come with a hefty price tag of Rs 720 million, represent more than just equipment; they offer a glimmer of hope for improved diagnostic services for the people of Punjab. The caretaker Health Minister, Prof. Dr. Javed Akram, emphasized the interim government’s dedication to…

Is Apple’s allure fading in the heart of China’s bustling tech market? The tech titan’s recent sales slump in China has left investors reeling, signaling a possibly worrying trend for the Cupertino-based company in the world’s largest smartphone arena. In the quarter ending December, Apple’s China sales plummeted by 13% to a stark $20.8 billion, falling short of the anticipated $23.5 billion. This downturn sent shares tumbling nearly 3% in premarket trading as the news broke out. China represents Apple’s third-largest market, making this sales dip more than a bump in the road; it’s a potential shift in consumer sentiment…

In the heart of Europe, fiscal prudence echoes from Germany’s halls of power as the Bundestag, the nation’s lower house of parliament, greenlights the 2024 budget. In a move that reinforces Germany’s commitment to financial stability, the approved budget adheres to the country’s stringent debt brake, signaling a continued conservative approach to borrowing despite the pressures of global economic headwinds. Germany’s debt brake, a rule etched into its constitution, curbs the federal government’s net borrowing to a mere 0.35% of the gross domestic product (GDP). It’s a self-imposed cap that has positioned Germany as an exemplar of fiscal discipline among…

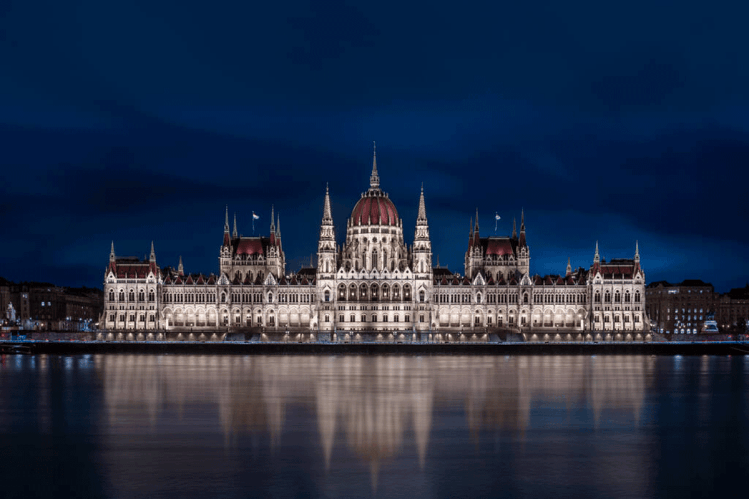

Is Hungary’s reluctance to ratify Sweden’s NATO bid a strategic maneuver or a political defiance? Budapest’s recent engagement at the Brussels summit revealed a tug-of-war with the EU, particularly after Hungary stood alone against a unanimous decision in December. Prime Minister Viktor Orban, known for his firm political stances, claimed he “went to the wall” for Hungary before conceding to the EU deal to support Ukraine with a substantial package of 50 billion euros. His stance reflects Hungary’s complex relationship with both the European Union and NATO, especially amid the increasing tension due to Russia’s invasion of Ukraine. While the…

: Are the winds of change sweeping through the Eurozone’s financial landscape? As we navigate the complexities of monetary policy and market dynamics, recent trends suggest a notable shift in the horizon. At the heart of this transformation is the yield on the eurozone’s benchmark Bund, which is poised for its most significant weekly decline since mid-December, indicative of a market stabilizing its expectations for future European Central Bank rate adjustments. The Bund yield, a key barometer for eurozone borrowing costs, has traversed a volatile path. It registered its first monthly uptick in January after a downward trend since September…

What’s fueling the rally in Sri Lanka’s stock market? In a remarkable turnaround, Sri Lankan shares have notched up gains for four successive sessions, driven by a robust performance in the financial and industrial sectors. The CSE All-Share index climbed a notable 0.53% to settle at 10,430.79, indicating a newfound optimism in the island’s market sentiment. This uptick marks a significant shift from the previous three weeks of losses, with the weekly gain totaling 0.92%. Interestingly, this resurgence comes amidst the Sri Lankan government’s announcement of securing a $150 million loan from the International Development Association (IDA) of the World…

Are Indian government bonds the new safe haven for investors? This week, the bond market has given a firm nod, with India’s benchmark bond yields taking a sharp dive, signaling a crescendo of confidence from market participants. The benchmark 10-year yield has bowed to a seven-month low of 7.0555%, spurred by a combination of fiscal prudence and external factors. This marked plunge, a hefty 12 basis points for the week, is the most substantial since November 2022, painting a clear picture of the market’s optimistic sentiment. The catalyst behind this bond bonanza? A federal budget that has struck the right…

Is fiscal prudence finally taking center stage in Poland’s economic strategy? Recent data from the finance ministry has spotlighted a curious development: the country’s budget deficit for 2023 nosedived well below governmental forecasts, thanks in part to an unexpected reining in of public expenditure. In a striking display of budgetary restraint, Poland’s deficit clocked in at 85.57 billion zlotys ($21.57 billion), a figure that comfortably outperforms the revised budget target of 92.0 billion zlotys. This announcement has rippled through economic circles, raising eyebrows and prompting a closer examination of Poland’s fiscal management. Read: IMF Predicts China’s Economic Slowdown Until 2028 Underpinning…

To get started investing in Pakistan, choose a strategy aligned with your investment budget, the timelines for your investment goals, and the level of risk that is suitable for you. If you’re new to the world of investing and looking to make your money work for you, you’ve come to the right place. In this guide, we will explore the basics of investing and provide valuable insights into the various investment options available in Pakistan. Whether you’re interested in equities, real estate, or other investment avenues, we will help you navigate through the different choices and make informed decisions. We…